On The Level: Forecasting and Our Big Rocks

Words: Isa Stein

Jude Nosek

A former boss told me he had two rules for the forecast: “1. It is wrong. 2. It will change.”

I was grateful for these guidelines. They gave me permission to be wrong (which I often am) and the organization an appreciation that the forecast is a prediction and must be treated as such. I have had the privilege and the challenge of helping Keson plan for our near future (i.e., our 12-month forecast) each year since I joined the company in 2004. Over that time, we have seen enormous changes: market, company, competitive, personnel and many other factors that have contributed to us not performing “to forecast”.

Some examples: Company personnel and leadership changes, company structural changes, customer mergers and acquisitions, competitive mergers and acquisitions, competitive new products, introduction of new technologies, introducing new products, new business partners, country-wide housing booms and busts, a worldwide pandemic and subsequent flare-ups, supply chain disruptions, fires in factories, tariff changes, and many, many more large and small influence on and disruptors of our forecast.

The vast majority of these events were not part of our annual forecasting process, nor could they have been. We set the course in the 4th Quarter, and we adjust as the subsequent year rolls along. We make our best estimates based on many factors, set our plans up and into motion and do the best we can. I suggest you make these two tenets part of your forecasting process.

Last year, for On The Level, I provided a few suggestions on forecasting. Here are some more suggestions and a bit about how we choose options to support the forecast.

HERE IS A LINK to last year’s article.

A Summary

Anyone can use these three models. In my opinion, they are healthy exercises to help find areas of strength and of weakness. Couple these models with a Market/Company analysis like SWOT (strength, weakness, opportunity, threat) to provide a reasonable forecast, and then a marketing plan for the coming year.

We use three forecasting models: A. Get What You Got, B. The Trend Continues, C. Targeted Action.

Forecast Model A : You Get What You Got

This year’s sales are next year’s sales.

Major Question: Can you run your business on the revenue you earned last year?

Pros of this model: Simple to put together. Easy to account for each area.

Challenges of this model: Things are going to change. Costs go up and (rarely) down. Your people are more valuable this year with an additional year’s experience. Market conditions change (labor rates, material costs, supply chain costs, etc.). If you only get what you got, what will you change to remain profitable?

Forecast Model B: The Trend Continues

This year’s sales growth is next year’s sales growth.

Major Question: Is it reasonable to assume that your growth will continue unchanged? If we do the same things, will we get the same trend results (vs. same results).

| Sales | Note |

| Year 1 | $100,000 | basis |

| Year 2 | $400,000 |

|

| Variation | $300,000 | |

| Growth % | 300% | (var/initial) as % |

Using the 300% “trend” produces a result that might be more than you’re willing to bite off.

| Sales | Note |

| Year 2 | $400,000 | |

| Year 3 | $1,600,000 | |

| Variation | $1,200,000 | |

| Growth % | 300% | (var/initial) as % |

That same $300,000 above sales your first to second year, if repeated is a less impressive percentage increase, but still significant growth.

| Sales | Note |

| Year 2 | $400,000 | |

| Year 3 | $700,000 | |

| Variation | $300,000 | |

| Growth % | 75% | (var/initial) as % |

Pros of this model: Simple to put together.

Challenges of this model: Minor Challenges: Don’t forget to consider your price changes. Be mindful of each revenue stream. We use the trend for each stream in our forecast, not simply the overall percentage. We choose this because our growth varies by product family, often significantly. Major Challenge: Percentages can be deceiving. You will likely have to make reasonable corrections for unusual growth, accounting for events that might not reoccur or may end completely.

For example, in 2019 we received an order from the US Army for thousands of our Made-in-the-USA, FLT-style fiberglass tape measures. That tape was added to the Army “kits” for fitness training around the world. We would have been foolish to continue to forecast this type of growth year-over-year because these tapes will not all be replaced in that time.

Forecast Model C: Targeted Actions and Activities

This year’s sales growth will come from these chosen revenue sources because of these chosen targeted actions and activities.

Major Question: Where are we going to spend our time and attention in the coming year? How will we allocate our resources (time and money)?

Pros of this model: Focuses attention onto the chosen critical areas.

Challenges of this model: Things might not change, even after you spend more time and energy on them. You might not have the influence you thought you would.

Big Rocks

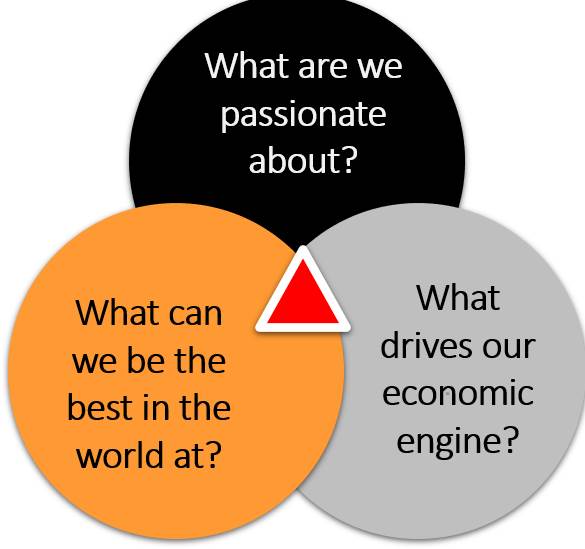

We then decide on a forecast that takes these three models into consideration. We take a look at the Big Rocks (our core products) of our business first, making cases for investments and communications around these. Our Big Rocks are Wheels, Measuring Tapes, Chalk/Chalk Line Reels and Levels. These categories fulfill three criteria: what are we passionate about, what makes us money, and what can we be the best in the world at. What happens in these core categories determines (for the most part) how we perform for the year.

Some Questions to Run by Your Executive Team and Salesforce

- What are your Big Rocks?

- How much reasonable potential exists for each of them in your market?

- How much more of that market share do you think you can earn?

- How will this happen (specifically)? Who is responsible for this growth? How will you measure it and report on it?

- What actions will your organization need to do to ensure (as best you can) this grow?

- What is the growth worth to the company?

- What percentage of that growth would you consider investing?

- How will you marshal your resources?

For us, our forecast is a chosen, reasonable goal to help us focus our efforts. How we go about achieving it and how we choose to invest our resources are critical questions we ask every year. Our team has been following this process for many years now. Each year, we find some novel choices, new insights and unique ways to use technology, communication tools, events, and personnel. We also employ some very consistent, repetitive (though often modified) techniques. For example, we have a very consistent rhythm of communication for our distributors and our sales force. What we say changes, but when and how we say it is very consistent. That consistency builds trust over time. That trust can help us achieve our goals as long as they are aligned with the needs of our customers.

“Big Rocks” comes from a story. A teacher shows her class an empty, see-through aquarium. She places 6-8 large rocks into the aquarium so that none poke over the top, and no more can be fit into it. She asks the class if the aquarium is full. Most students say yes because no more big rocks will fit. She then takes a bucket of pebbles and fills the aquarium with as many pebbles as possible up to the top edge. Again, she asks the class if the aquarium is full. More wary now, some of the students say yes. The teacher then pours cup after cup of sand into the pebble- and rock-filled aquarium until the sand is to the top rim. She asks, is the aquarium full? Only a few say yes. She then adds cup after cup of water into the sand-, pebble- and rock-filled container. She asks, is it full? And finally, all agree that, yes, the aquarium is full. The point, the teacher explains, is that if you don’t get your big rocks in first, you will never be able to fit them in later. So, prioritize your big rocks.